I just posted the end of my savings journey for my 2019 Girls Trip. In seven months, I was able to save $1326.44, which was $276.44 more than my original goal of $1050.

My trip is completely paid for, in cash, with no credit card debt and no money taken from our household budget. I leave in a week with an extra $277 dollars in my pocket, to spend or save for the next trip. I did it all as a stay at home mom of three, including my Teacup, who is under the age of 1.

But enough about me. Let’s talk savings.

I see so many astonished comments in the SavEars when people share their trip earnings: “How did you do this?” “I can’t make these apps work for me!” “I don’t have 6 hours to sit around on surveys all day.” Girl, same.

I did not save for this trip by sitting on my computer from 9-5, ignoring my children. I did not do it in two weeks. I did not use every single app under the sun. I focused on the apps that worked well for me, the ones I enjoyed and were intuitive. I took moments when I could spare them, naps, an extra episode of Doc McStuffins, the school pick up line, to mess around with survey sites. And here’s the most important part: I knew it was going to be a journey. When I started seven months ago, I knew there was a reality that I might not make/save/earn/wish the money I needed for my trip and I might have to adjust. Disney trips don’t come cheap or easy, but I promise you, they do come.

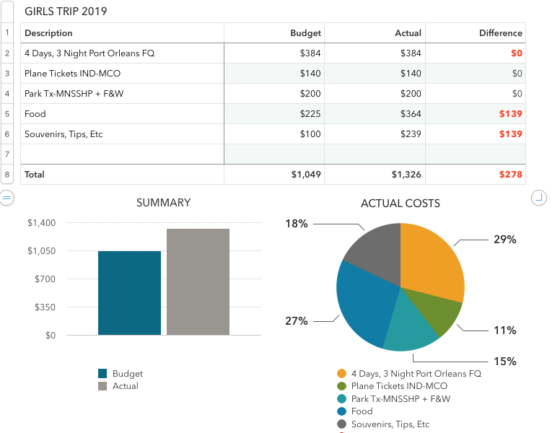

Here is a look at my budget.

This is a Girls Trip with my best pal, so I am only paying half the cost of the room and for my park tickets. When it was a solo trip, my room budget was similar, but I was going to do a value resort and two nights instead of three. Which brings me to…

Tip #1: Plan for the budget you have, not the budget you wish you had.

Look, we’ve all seen the commercial where the kids show up for their vacation at the Grand Floridian and Cinderella runs down the stairs and a Storm Trooper gets in the elevator. The Grand Floridian is between $500-$600 a night. I promise you there are just as many magical moments at a value or moderate resort. If a deluxe is in the cards for you, awesome. Bring me with you. But if it’s not, that’s okay, too. There is no one “right way” to Disney. So make it work with the dollars you have.

I mentioned that this took me seven months. And when I say seven months, I mean seven months. I just did my final cash out from my apps yesterday. When I started this crazy enterprise in February, I had $0. It usually takes me 12-18 months to save for our family trips, so this was a tighter turn around that I am used to. Which brings me to…

Tip #2: Prepare yourself mentally for the long haul.

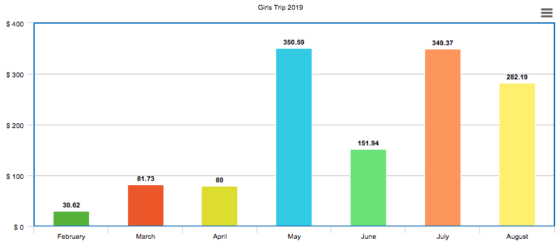

Check out this chart. It shows how much I saved each month.

The first thing your eye might be drawn to are the impressive months of May and July. But look further to the left and check out the sorry state of February, March, and April. Savings is a marathon, not a sprint. You don’t see a lot of results at first because you’re banking up the coin. Don’t get discouraged a few weeks in! My first month I saved like, $6. Keep on keeping on. You gotta do the work up front to collect the dollars in the end.

All of the money earned/saved/etc is the product of one of Saving to Disney course methods, or an app recommended by Couponing to Disney. I see this question all the time, “Do people actually use these apps to pay for vacations?” We do! Let’s break down how.

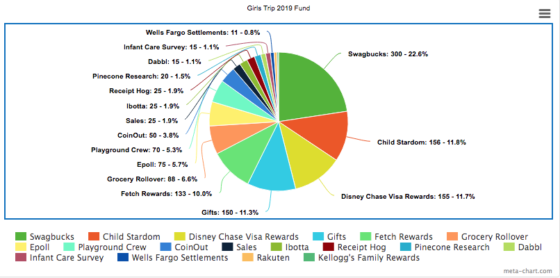

This pie chart illustrates each category my Fund savings falls into. I’ve broken these down into specific categories (by app or site or source) so I could see how much each particular app has earned.

Now on this pie chart I’ve grouped like categories together to illustrates how much money I made from each method of the Saving to Disney course and what percentage that was on my total savings.

Swagbucks = $300

My top earner, with 22.6%. I’ll be honest, I don’t do a lot of the moneymaking deals because I have an infant and some days I cannot even find my pants. I stick with surveys, and occasionally I’ll get a great study that pays out really well. I set myself a time limit on SB, say 30 minutes, and then I move on. It’s a great earner if you can get into a rhythm with it. We talk about it a lot on the blog because it works well for many different cross sections: survey takes, couponers, internet shoppers, etc.

Cash Back Apps = $242.18

My second biggest earner was a variety of cash back apps that I use on my phone. These are all receipt scanning apps, that give me a various percentage back that can be redeemed for gift cards or PayPal deposits. Remember that part where I said I didn’t have a lot of free time on my hands? These are all very simple, low effort apps that give me cash back on things I have already bought. I am all about making my life easier. In descending order of earnings, Fetch Rewards ($133), CoinOut ($50), Ibotta ($25), Receipt Hog ($25), and Rakuten ($9.18), are all apps I would highly recommend in terms of payout to effort ratio.

Found Money & Sales =$ 211.40

Okay, so my long lost Child Stardom ($155.69) was a complete fluke, but a well paying fluke.I am going to count this as a settlement, along with Wells Fargo Settlements ($10.71). These are income additions that cost me nothing more than filling out some paper work. C2D reports data breaches and class action suits regularly. Many times, you may not even know you were affected and entitled to a payout. It takes two seconds to check, and that money can accumulate. In this category I am including money I made through selling my used items ($25), as well as money I made through a study that sought me out after I had the Teacup ($15) and the gift card I earned through Kellogg’s Family Rewards ($5). These fund opportunities are presented by other people, and you generally don’t have to work too hard for them. They include things like using rewards on current accounts, money you make from having a yard sale, reducing your monthly bill, or using trade in programs.

Survey Sites = $180

I grouped al these survey sites separate from Swagbucks, because Swagbucks is a little beyond the scope of the others. Swagbucks is a survey site and earning app rolled into one. Most other survey sites are a little more specific in objective and content. Pinecone Research ($20) generally has surveys about food and household items. It pays out $3 per survey and you are always prequalified if the survey is sent to you. Playground Crew ($70), which I got an invitation for through Swagbucks, incidentally, has surveys only about toys and baby items. E-Poll, one of my faves, has surveys about movies, television, and other celebrity/entertainment content. Dabbl, an app new to the survey game, has short ads you answer a few questions on. These are more involved than the apps, but if you find these topics interesting (which I do) they can be a lucrative way to pass the time in the pickup line at school.

Disney Chase Visa Rewards =$ 154.37

If you are working your way out of debt, this Saving to Disney method may not be for you. And that’s cool! If so, skip down to the next method. If, however, you are in need of a credit card, this one worked out well for us. There are in park rewards we take advantage of, discounts at stores and restaurants, and a fun photo op! But the real draw for us is the percentage back on purchases that can be redeemed as Disney rewards. We do this the same way every time: pay for our vacation using the Disney Chase Visa. We get 2% back on whatever we charged in the form of rewards. We then immediately pay that balance off with the cash we saved. We only use this card for vacation, so we don’t run up a high balance. Like I said, it’s not for everyone, but it’s worked really well for us.

Gifts = $150

Utilizing gift money is a great way to save for Disney. It is money you are not expecting, so it in no way affects your budget, and it often comes at the holidays, which can be a harder time for saving. You can read more about that strategy here.

Grocery Rollover = $88.29

The Saving to Disney course completely transformed the way we planned and purchased our groceries each week. So much so, that I write a weekly column about it here on the blog. Between couponing, shopping to the sale, budgeting, we now get more food for half of what were spending pre-S2D course. The method of rolling over surplus and deficit week to week has also enabled us to stretch our dollars. So of those dollars are so stretchy they would us as monthly overages that went straight to our Disney fund. Worth noting, we have special dietary needs because of my husbands Type 1 diabetes, so the majority of our food is produce and protein, not the cheapest items on any grocery list. If the Saving to Disney course can work for our high cost food, it can work for anyone.

Okay, so we’ve done tips, we’ve done charts, we’ve done graphs. All that’s left are tricks. So, here’s the trick to funding your Disney World Vacation.

There are no tricks.

Kristin Cooper started Couponing to Disney because she was LITERALLY couponing to Disney. When I started using her methods, we were a one income family who had been to Disney twice. Since I did the Savings to Disney course, we’ve been every year. Not because we racked up a ton of credit card debt or because there’s some Free Disney Vacation button we pushed that no one else knows about. Because we took sometimes small, but always intentional steps, to being better stewards of our money. We shop sales and clearance, we don’t eat out very often, we scan every receipt we come across, I do surveys during naps instead of starring blankly at the wall in silence for 45 minutes. There is a lot of work on the front end when you get started but I promise you that it all shows on the back. And if you don’t believe me, look at these charts and graphs. Numbers don’t lie.

So this was my seven months savings journey. As soon as I get back from this trip, it’ll be time for a new journey. But these savings journeys are so worth it because the destination is not just Disney. It’s a family experience where we will make magical memories that we’ll treasure forever.

How is your savings journey going? When is your next Disney trip? Which Saving to Disney method is your favorite? Let me know down below!

Kristen B. is wife to the best Prince around, mama to the spunkiest little princesses, and lover of all things Disney. She started her savings journey five years ago and is now dedicated to making her family’s wishes come true one coupon at a time. She is so excited to take her love of saving to the next level and share her journey with you! Click here to catch up on Kristen’s Savings and join in on your own savings adventure!

Kristen B. is wife to the best Prince around, mama to the spunkiest little princesses, and lover of all things Disney. She started her savings journey five years ago and is now dedicated to making her family’s wishes come true one coupon at a time. She is so excited to take her love of saving to the next level and share her journey with you! Click here to catch up on Kristen’s Savings and join in on your own savings adventure!

Myeshia Underwood says

So much great information rolled into one post. I hope you have a great trip!

Linda says

Thank you for sharing . I enjoy reading your articles .