Hello friends! I am so glad you are starting to work on the list of things you can do right now to start saving money. Print out or open up the PDF Checklist if you’d like to track your progress down this list.

Below you’ll find more information on the checklist items.

1. Cancel Subscriptions/Memberships – Streaming, Monthly Boxes, Apps, etc

I know it is nice to be able to enjoy luxuries such as streaming services, subscription boxes and apps….but as you begin to look for ways to save money, these have to go. You can always renew later on (and maybe get a deal when you do).

Take a look at your statements and find all the ones you have signed up for to make sure you cancel what you can. Also think if you have any quarterly or yearly subscriptions that will come out. I just remembered my yearly Prime Membership was due and they upped it to $149! I think no.

If you are on the fence, you can always resubscribe later on. But for today, I say cancel it all.

2. Unsave Your Credit Card Number Online

Impulse buys sneak up and get you! Whatever website you have used in the past month, go make sure your credit card number isn’t stored anymore. This includes the popular websites too. If you have to get up and go find your purse/wallet to make a purchase, you are less likely to do it.

3. Gather All Your Loose Change

I know this seems like a given…. but a lot of people just throw their change haphazardly around the house, their purse/bags and in the car. Get a jar and go gather it all up into one location. If you have a decent amount, find out if your bank has a free change machine to count it for you. You can also use CoinStar machine and if you choose one of their gift cards, they don’t charge you a fee at all.

4. Evaluate Your Bank Accounts, Look For Rewards or Shop Around

Bank Account

How long have you had your bank account? Is it the best account for your family? It’s time to evaluate your bank account and see!

First step is head to your bank’s website and check out their options for checking and savings accounts. Is what they are offering now comparable to what you have? If their accounts now have rewards for debit card purchases or no fees, have they adjusted your account to have the same? If not, give them a call.

The next thing to consider is changing banks all together. I changed to a local credit union in my town and they gave me a $200 bonus for switching and meeting specific qualifications. Is a bank in your area offering an incentive for switching? Check out some of the banks websites and see. Don’t just switch because the bank is offering a bonus…make sure it is the best fit for your family.

Rewards

Did you know that some banks offer points or rewards for using your debit card? Some offer reward points if you swipe your debit card as a credit card (my former bank did). This is a very easy way to earn rewards that can be cashed in for gift cards, credit or cash for your Disney fund!

You can usually find out if the bank offers rewards right on their website. My bank gives me cash back at select merchants when I use my debit card as a MasterCard. It shows up underneath the charge on my online banking statement and I have to manually select that I want cash back. It also offers me additional discounts at some merchants.

Also, be sure to check your credit cards and make sure you are redeeming the rewards you earned by using them. A lot of these rewards will expire without people knowing. Some places offer Disney gift cards as one of the rewards. Be sure to check to see if yours does!

5. Visit Websites For Stores and Restaurants You Frequent

Many grocery stores, restaurants and shops in your area are starting up new programs during this time to incentivize customers to shop. Take a moment to visit the websites of the places you frequent to sign up for newsletters, rewards programs and check sales circulars. Some even text you when their new sales circular starts.

6. Browse The Grocery Stores Sale Circulars

I always go to multiple stores to buy my groceries even when I am not using coupons. Check your local grocery stores for their sales circulars and see if anything you routinely buy is on sale. I buy groceries every week at Publix, Aldi’s, Walmart and the Farmers Market. The savings have ALWAYS far outweighed the gas/time it takes to go to multiple stores.

7. Find New Recipes With Less Ingredients

We get into a habit of making the same handful of recipes and not trying anything new. With the rising costs of food, it’s time to get creative! Think about what your family likes and hunt for recipes. Here are some of my search tips:

- Search for 2 ingredients based on what you have on hand – example Chicken, Onions

- Go to Pinterest and search how you want to cook the recipe – example Chicken Oven, Beef Slow Cooker

- Search for 3-5 ingredient meals – example Chicken, 5 ingredients (they often put it in the recipe title making it easier to find)

- Use the “Jump to Recipe” button – Food bloggers have to be wordy because of search engines. They have a button they put up near the title or under the first image that says “Jump to Recipe” to save time for the user

8. Check Your Insurance Policies To Make Sure You Have All Discounts Applied or Shop Around

If you haven’t looked at your insurance policies in the past 6 months, you need to. Check with your company to make sure you have every discount available to you applied to your account. You might even consider shopping around. We saved $150 a month over what one company was offering us to insure our 18 year old on our policy. It is definitely worth checking to make sure you make the most educated decision possible.

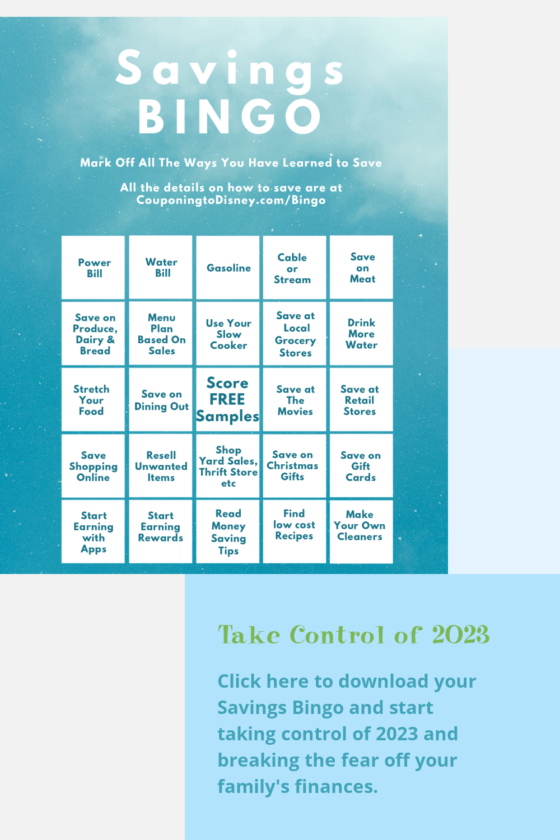

Find out all the ways to save with our helpful Savings Bingo!

Leave a Reply

You must be logged in to post a comment.