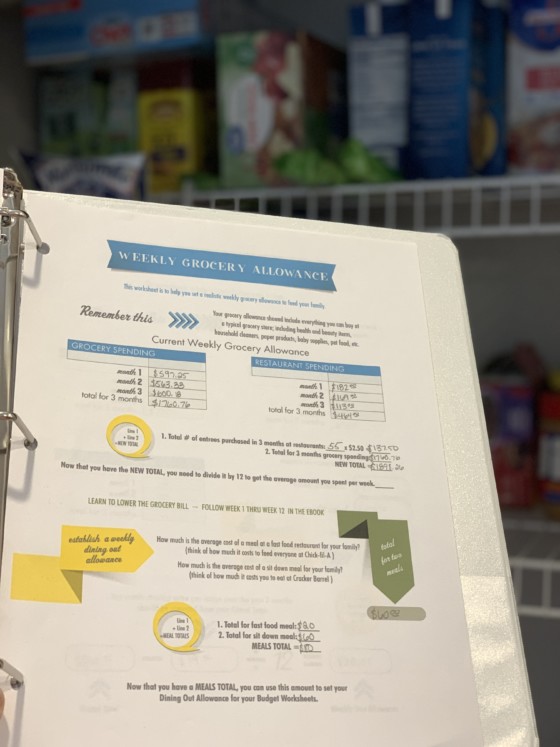

In order to grow your Disney fund, you need to set a grocery budget. The idea of setting a budget can be extremely overwhelming. It’s very important that you take a deep breath and set a realistic goal. Here’s the steps to follow to set your family’s grocery budget:

1. Gather up all receipts, bank statements, credit card statements etc from the past few months. Go through each of them and figure out what you spent at the store and what you spent going out to eat. Start with 3 months ago and figure out what you spent in that month. Do the same with 2 months ago and then what you have spent in the past month. Now pick your jaw up off the floor. It’s going to get better. (If you don’t have your statements, spend a good 5-10 minutes racking your brain to try to figure out what you might have spent. I’m sure it will come to you, eventually.)

The reason I told you to add up what you spent going out to eat is because I want you to get a realistic figure. You could have gone out to eat for dinner every night in that month and only spent $150 at the grocery store. Obviously $150 would not be your realistic budget amount.

2. What you spent in the past month is a great starting figure. I want you to divide that number by 4 and that is your new weekly grocery/dining out budget. If that figure seems incredibly overwhelming, you can go ahead and reduce it by 10%. If you reduce it too much, you are setting yourself up to fail. While you are learning to coupon, you need some wiggle room!

Be sure to pick the date that your grocery budget will reset. Mine resets every Thursday.

3. For the next 2 weeks, I want you to take a very realistic approach to couponing. I don’t want you to set your expectations too high. It is very important that you don’t overwhelm yourself because couponing can/is very overwhelming at times.

Here’s what I want you to do:

- Gather up the store ad(s) and plan your menu based on what is on sale. Before going to the store, I want you to visit their website and read thru their rewards programs.

- Pick one drug store to shop. Shopping at more than one will be very overwhelming when you are starting out.

- Check out the Walmart and Target deals and add them to your list if you want/need to.

- Go shopping by yourself or with a friend. Don’t take your kids on your first trip out if you don’t absolutely have to.

- Keep saying to yourself “Okay. My weekly grocery/dining out budget is X amount. I am NOT going to spend over that amount and anything that is left, I can add to my fund if I want.”

4. After the initial 2 weeks is over, I want you to take a look at what you spent verses what your grocery budget is. If you managed to save a substantial amount less than what you spent, go ahead and reduce your budget by another 10%. If you spent close to your budget amount, wait another 2 weeks before evaluating it again.

5. Every 2 weeks I want you to compare what you spent verses what your budget is. While in theory it would be great if your budget was $250 a week for groceries and you only spent $50 and were able to save the other $200, it’s not always practical. There is a chance that you were overspending on groceries/dining out and other areas of your budget were suffering because of it. It is important that you get your weekly grocery budget down to a practical amount.

Example:

The Smith Family (Mom, Dad, Daughter, Son) has not followed a grocery budget for some time. Mrs. Smith goes to the grocery store a couple times a week without a shopping list. She throws whatever appeals to her in the cart and when she gets to the register, she groans as she swipes her credit card. Mr. Smith goes out to lunch everyday and picks up take out a few nights a week. On the weekend, they stop for fast food and go out for dinner on Sunday night.

When Mrs. Smith sits down to figure out her grocery budget, she adds up what they spent at the store. She is pleasantly surprised to see she is able to feed her family of 4 for just $450 a month. But then she adds up all their dining out costs. She is shocked to realize she has spent an average of $1100 a month on food for the past 3 months. No wonder they are starting to feel the squeeze in their bank account and their bills are getting paid a little later than they used to.

So Mrs. Smith decides to set her budget. She could say “Ok, I am going to set my budget at $100 a week.” But that isn’t realistic for her family. They have got to change their spending habits and if the first week out of the gate she sets the budget too low, they will fail and say this isn’t worth it and give up. So following this advice, Mrs. Smith sets her budget at $275 a week. She gets out the ads for her local grocery stores and sets a meal plan for the week based on what is on sale (she doesn’t try anything new, she sticks with meals the family likes and she knows how to cook). She plans at least 5 meals that she will cook and 2 meals of convenience foods. (The Smith Family is less likely to go out for pizza if they know they have a couple of their favorite pizzas at home in the freezer.) She also makes sure to get plenty of breakfast and lunch foods, snacks and beverages. She also prints out the lists for her local drugstore (I suggest you only start with one when you are getting started) and checks the under $1 lists for Walmart and Target to see if she needs any of the items.

Mrs. Smith heads out to the grocery store with her list in hand. She picks up what she needs at the drug store, Target, and Walmart. She comes home smiling because she only spent $199. She has $51 to last her until the week is out. But Mr. Smith forgets his lunch one day and spends $11 on fast food and she ends up running through a drive thru to get milkshakes. At the end of the week, she realizes that she still has $33 left! She is very proud of herself and feels like this is going to work for her family. Since the Smith family is still feeling the pinch, they decide to leave the money in their bank account to cover bills. But they celebrate at home with a family game night (free!) and their store bought pizza.

The next week comes and Mrs. Smith is starting to get this figured out. She still has groceries left from last week. There are better sales this week and she feels more confident and decides to shop at 2 grocery stores instead of just one (after all she did have some money left last week to cover the additional gas and the second store is having a great sale on meat). She also finds dining coupons for her husband to keep in his truck (in case he ends up going out to eat again). By the end of the second week, she has $68 left!

Mrs. Smith sits down and takes a look at her budget. Since she had $33 left the first week and $68 left the second week, she decides that she can reduce her budget by $30. Her new weekly budget is $235.

And so it continues for the next 3 months. Every few weeks she is able to reduce her budget even more. By the end of the 12th week, she is now spending just $125 a week for her family of 4. Their bills are caught up and they no longer feel the crunch in their bank account. They decide that they are now comfortable with setting a weekly grocery/dining out budget of $150. Each paycheck, she withdraws her grocery budget in cash. She spends as little as possible and deposits the difference into her fund. Since she would have spent the entire $150 if she wasn’t couponing, she feels great every time she makes the deposit. And by saving for something her family wants to do (maybe it’s a trip to Disney or a new TV), they are on board and actively try to keep the budget down (because face it, it’s hard to do it without the support of everyone in the household).

And that my friends is how the Smith Family does it!

5 Days to Start Saving for Disney

You will also learn how to set your grocery budget on day 2 of the Start Saving for Disney newsletter. It includes more information plus a printable from the Saving for Disney course that you can use to help you.

Be sure to take the time to catch up on the Saving for Disney Challenge.

Crystal says

hello and thank you for your great advice on how to budget its extremely important for me I am a single mother of two boys andi try to budget every way I possibly can, if at all possible could you email how to break down a budget for shoppin once a month. I am a major coupon freak I try to get all I can I only shop once a month for groceries with a budget of 200 can you help to get as much as possible with what little I have please and thank you kindly for all your help

Rhonda Childress says

I started setting a budget last year 2013 because I knew we were spending way too much at the grocery store especially with all the eating out we did. I found my grocery bill going down but we were not saving any money because I then took notice of how much money we spent eating fast food during the week at least 3-4 times per week. I than cut down on this to once or twice a week. My problem however is that the community I live in is small so for most of my shopping needs grocery, cloths etc. I have to head out of town at least 30 minutes or an hour away. This usually takes several hours counting the driving time and if I have other errands like haircut, etc. So I find myself eating lunch out. Sometimes this is just me and sometimes it is my kids. This messes us my budget sometimes and I sometimes have to travel out of town. My daughter is in college two hours away so I travel to spend some time with her once every 4-5 weeks and I have to travel some with my job so this blows my budget. Any suggestions especially with the traveling with the job.

Carol Lyn Wauford says

I am just curious, we get paid every other week so I have always done my shopping on payday. Is shopping every week a ‘trick’ to help get the spending down because of the changing sales or would it work if I stick with every other week? It seems we spend SOOO much more than we should AND end up shopping mid pay week anyway, …it is a pain to shop every week but it is starting to make sense to me Thanks!

Laura says

Kristen,

I still consider myself a newbie since I have been couponing less than a year…I have never set a grocery budget and after reading this on spring break, I am setting one as soon as we get home. Though I cook or we eat at home, we also do a lot of eating out. This is a big “MONEY WASTER” instead of a “MONEY MAKER”!! I can’t wait to get home and try a budget…I am thinking of meal planning as well…WOOHOO!! thank you for your site!

Jessica W says

Love This! We started a household budget in January and the grocery budget is one I’ve been struggling to get right. Thanks for the great tips!

Chelsea says

It’s so wonderful of you to post all this info for us! Thanks so much for all the advice and tips!

Melinda says

My DH has been with out a job for almost 6 months and it has been hard on our family. I have found out though that if you stick to a food budget you can actually make that budget stretch for a month. Before my DH lost his job we use to eat out every friday night but now we are lucky if we get to eat out once a month. I want to thank you for everything that you do to help us save money

Rebecca says

Thank you, thank you, thank you for your Smith Family story. It honestly was super easy to understand when you broke it down like that. I have been following you on FB for a few months now and spent this weekend viewing your videos and tips. After eating out most of this weekend I had to throw away 2 packs of spoiled chicken breast…I thought “What would the CD lady do” LOL so I just bought a foodsaver from amazon they had the red one for 64% off. And will be able to seal up my extras and store them in my freezer and have meals to pull from. We are saving for your Jan 2013 Disney Fantasy Cruise and with your help we should be able to save for our next one soon. Thank you again for all you do.

Karen says

I have been couponing for years now. I visit several online sites each week for printable coupons and check out the sales fliers. The only way I splurge on something out of the necessities is if it is on sale and I have a coupon. Yet some how I still spend on average $150/week on food and supplies for 2.5 people (expecting our first child this spring and we have furries). Part of the issue is I have a medical condition that forces me to buy special foods that are rarely on sale and can never find coupons for. Does any one have any ideas on how to help get this down?

Kimberly says

Thanks to the great advise. When my husband left last year, I started working on my budget & was doing pretty good for awhile. It kinda fel apart at the beginning of summer without realizing it. I am once again committed to stay on track. Wish me luck, this week is budget setting week.

Terri says

OK I admit I am a Disney Freak!! Recently went to Florida with extended family and not everyone could afford Disney so we did not go (We had all gone 2 years before). However I could not be that close and not do SOMETHING DIsney so my daughter (who I am corrupting to be a disney freak) went to Downtown Disney. Just being there sent chills down my body. I love the music and the feel of it all. ANYWAY! That has put the bug in me for a 2012 trip. I am 4 months into couponing and have a small stockpile. Have never had a budget but sat down as soon as we got back from Florida and wrote out all my bills and maped it out. I’m going to start and take the budget challange to get my Disney fund going. Going to need all the advice and support I can get. I have a downer for a husband and he doesn’t think it is possible for me to get a handle on our money. I say “WATCH ME”.

Pamela Cofer says

Ok, so we have 2 boys, 11 & 4, and really wanna go to Disney next year. Had planned on just using our tax return to do it, but I think (after being a subscriber for some time now to your posts) that I’m actually gonna bite the bullet, so to speak, and really put forth an honest effort to do it this way instead, freeing our tax money up for whatever else may come down the road (seems there’s always something wearing out, breaking, and hubby will need new transportation soon!).

Not “brand new” to couponing, but definitely not a veteran, either! Really small pantry, but have stocked it rather well, and my non-food items are also well-stocked, leaving only refrigerated and frozen items to buy on a more regular basis (and frozen will cut down more once I can afford an upright freezer to keep in garage!).

Thanks for all you do to help I don’t even know how many people like me, I really appreciate any and all of your help, and hope to one day real soon be able to afford to take my family to Disney! (The last time I was there was when EPCOT was brand-new!!! Yipes! ahahha)

Thanks again, and keep up the great work! :)

Lynne says

Hi Pamela,

Just a slight tip for you. If you live in a warmer area, you may want to see if you can squeeze your upright freezer in your house. Garages tend to fluctuate in temperature with the summer months. The heat in the summer during the day will make your compressor work extra hard, and with the garage closed most of the day, the heat can’t dissipate, causing your freezer to break. The replacement part will often cost more to repair than replacing the unit. My husband is a commercial refrigeration tech in AZ, so he enlightened me when I suggested a soda fridge or extra freezer in the garage.

If you are looking for an inexpensive model, try checking http://www.searsoutlet.com (the Sears outlet store), to see if there’s one near you. They have scratch-n-dent, open box and new models at a deeply (30% or more sometimes) rate. Shipping/delivery is also usually offered for a fee.

Good luck!

Cassie says

Changing behavior is hard. Your plan to gradually reduce the food budget is a ensure success.

Angela W. says

That’s an awesome example, and i wish that was us. But what happens if you don’t have enough money to make it a realistic budget?

Kellie says

Your awesome! Very inspiring!!

Linds says

Very cool post- I need to get back on track! Hubby wants me to use the card for groceries so we can get the points and just keep track with receipts.

Bree says

Thank you for taking the time to write this long, but very informative post! I have started a budget after seeing your little money organizer. Great idea to work with your budget and not just set yourself up for failure!

In my house, we have weird weeks. Example, the first week of May we were $50 under budget and the second week, we were $40 over. This seems bad, but when we look at the overall budget of the two weeks, we actually did pretty good ($10 under).

We looked back over the past few months and it seems we always have a week where the sales weren’t that great and another where the sales were awesome! But in the end, we’re still within the budget and that’s what matters.

renee says

I like the detailed explaination. Like Gary, I also use mint. It is a great tool. It takes a couple months to tweak it a bit but it is well worth it. They actually send you email notifications if you are over budget in one of your categories.

Gary Bacon says

Great article! Back in April I evaluated my spending habits on food. One thing that helped me a ton is using http://mint.com — it’s free. They are trustworthy. Intuit, the company that makes Quickbooks and Quicken bought them. It will auto-categorize your spending ( for the most part you still have to go through and correct some items). And then give you a breakdown and suggestion for budget based on your spending habits.

I realized I was going out to eat WAY too much. So I started cutting back and cooking more at home. And bringing my lunch to work. I’ve been trying to coupon more towards food. I usually go for the toiletries and non-perishables. That’s what I’m working towards – “real food”.

Kristin, your plan is wonderful. I’m not where I want to be but I do have to remember to be conscious of my food spending. This post helps with that. Thanks so much! Having a plan is key.